Keep on Balance Sheet

Grow Reciprocal Deposits

IntraFi® network banks can use IntraFi’s services to grow reciprocal deposits. Relative to many other bank funding options, reciprocal deposits tend to be more stable. They enable greater balance sheet flexibility, reduce collateralization and tracking costs, and attract large-dollar deposits — all of which can increase profitability and lead to enhanced ROA and ROE.

We Invented Reciprocal Deposits

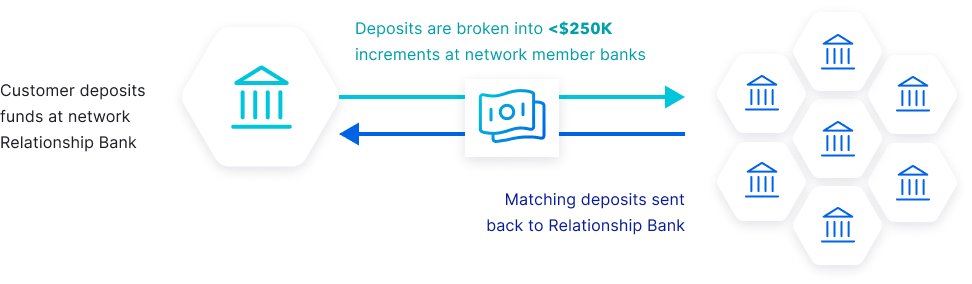

Reciprocal deposits are deposits that a bank receives through a deposit network in return for placing a matching amount of deposits at other network banks. IntraFi is the #1 provider of reciprocal deposit services and its reciprocal deposit option is available through ICS®, CDARS®, and IntraFi SweepSM.

Prior to the invention of reciprocal deposits, many large-dollar, safety-conscious depositors were reluctant to deposit their cash at just one preferred bank because their deposits could only be insured up to $250,000; they feared losing money if their bank failed. With reciprocal deposits, customers are able to work with just one bank to access millions in FDIC insurance through a network of banks.

Benefiting communities, banks, and their customers

High-value customers such as businesses, nonprofits, government entities, and high-net-worth individuals are quick to understand the value of working with their preferred financial institution to access multi-million-dollar FDIC insurance through a network of banks. Additionally, many appreciate that the full amount of funds placed through reciprocal deposit services can stay local to support community lending.

Most reciprocal deposits are reportable as core

Since IntraFi introduced reciprocal deposits in 2003, their use in the banking industry has grown to regular outstanding balances of hundreds of billions of dollars. For bankers, reciprocal deposits are a reliable funding option that can help grow franchise value because they tend to be lower-cost deposits and to be “sticky.” Reciprocal deposit offerings frequently attract large deposits (six, seven, eight, or even nine figures at a time) from loyal, local customers. Most reciprocal deposits are treated as core, nonbrokered deposits up to the lesser of $5 billion or 20% of liabilities for a well-capitalized bank.

Reciprocal deposits compare favorably to alternatives

What Bank Leaders Say

Reciprocal deposits are popular because they tend to be associated with multi-million-dollar depositors, enabling banks to attract deposits in large chunks with lower acquisition and maintenance costs as costs tend to be spread over much larger deposit amounts. Moreover, they result from deposits that tend to come from local customers at rates that are more in line with local pricing norms. They also tend to result from customers who are more likely to be interested in a broader, more long-term relationship that may include mortgages, credit cards, and other profit-generating services.

President

CenterState Bank

In stark contrast to listing service deposits, reciprocal deposits help a bank build franchise value. Quite simply, reciprocal deposits tend to be large, lower-cost, in-market deposits and, as such, offer greater potential for opportunity and efficiency. For this reason, many banks are replacing at least a portion of their listing service deposits with reciprocal deposits.

Former EVP and COO

Community Bank of the Chesapeake

Our public funds customers appreciate knowing that when they place their funds through ICS and CDARS, those funds are eligible for FDIC protection beyond $250,000 and earn interest. That benefits them, as well as local taxpayers, as our bank can make those funds available for investment within the community.

Chairman and CEO

Catskill Hudson Bank, NY

A Game Changer

Add reciprocal deposits to your toolkit